Price is perhaps the most crucial aspect of the marketing mix to determine whether customers make the purchase. If priced too low, profit goes out the door and you must work harder. Priced too high, customers will overlook you. This article discusses several pricing strategies that businesses can use.

Welcome to week fifteen of 50 weeks of marketing. This week's blog explores price and the numerous pricing strategies that businesses can use.

Pricing

“One of the more basic, yet critical decisions facing a business is what price to charge customers for products and services.” (Morris, 1987)

Factors that impact the price

There are several factors to consider with a pricing strategy.

The first factor to consider is cost. Or, what your time worth? Cost Plus takes into consideration production costs, then adds a certain percentage of profit to that total. This is a basic way to price a product, and often business use more than one pricing strategy in unison. There could also be other internal considerations within the business that can impact pricing such as quality.

The perception of value in the minds of customers is another important contributing factor a business must consider with their pricing. What do consumers think a reasonable price to pay is? Price and value will not always align with customers, and this perception of value will change over time. The more a business understands what their customers value, the easier it is to price your offering.

“This decision is particularly critical in what The Economist (2013) calls the “age of austerity” — an era characterized by sales stagnation, no reasonable possibility of cutting costs further, and price as the only remaining lever. In this competitive environment, more than ever, a sound pricing strategy is required to facilitate customer value creation, structure price decisions, and earn a profit. (Kienzler & Kowalkowski, 2017)

The competition, of course, must come into consideration. What are they doing? What are their prices? How does their product or service compare to yours? If there are similar offerings that are equally attractive but at lower prices, then you probably will not have many customers.

Economics is going to impact your market and therefore your price also. What is the economy doing? Are people willing to pay a premium? Is there a shortage of supply? How highly regulated is the market? We have recently had the Covid-19 outbreak around the world, forcing many businesses to close and changing business environments. There are now many incentives required to bring customers back to some industries where there has been a reduction in demand. Demand will have increased for other services such as delivery services.

Getting the price right

Pricing your products exactly right to get the absolute maximum profitability is easier said than done. Getting the highest volume of sales must balance at a profitable price. You could have the most brilliant math minds in the world looking at every single statistic possible to create a calculation for maximum profitability, and still not get the price right. There are so many factors outside of your control. Having said that, there are many things a business can do to ensure they are not getting it horribly wrong. Pricing decisions can have significant and disastrous consequences.

It is often the first and most important considerations for customers and it determines your profitability and ultimately, your success. It is the only marketing tool that provides the income — every other activity is an expense.

“Developing an appropriate pricing strategy is both crucial and highly complex. Prior research emphasizes its dependence on various factors, such as the environment, firm objectives, customer characteristics, and the pricing situation” (Kienzler & Kowalkowski, 2017)

Pricing Strategies

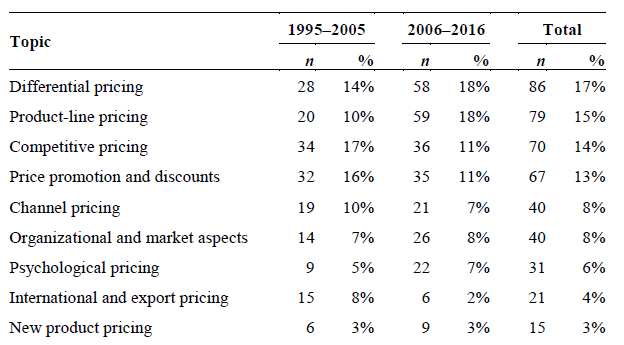

There are several methods and strategies a business can use to price their products. At a basic level, there four basic pricing strategies — premium, penetration, economy and skimming. I will discuss these along with several other strategies that businesses can use in unison in their pricing strategy. Kienzler and Kowalkowski (2017) identify many of these as being the most discussed in the marketing literature over the past 20 years. The eight other strategies are Loss Leaders, Differential, Competitive, Price Promotion and discounts, Psychological, Everyday Low Price, Bundled and Captive.

Premium pricing

Using a price structure that is higher than many of your competitors is a premium pricing strategy. The premium price alludes to the fact that the product or service is of a much higher value, usually consisting of a certain competitive advantage or unique characteristic in the minds of customers. Like a Ferrari or Aston Martin. They have a certain look, high performance and level of luxury not found in a Toyota or Ford. Keeping the price high creates an impression of higher quality than alternatives. You are unlikely to ever see a stock clearance sale on a premium brand.

Penetration pricing

The strategy with penetration pricing is to under-price a new product or service initially to gain market share more quickly. It is common with a product launch, increasing the price after this initial promotional period. The aim is to penetrate the market and steal customers away from competitors. If you can get customer loyalty and positive word of mouth during this period, that also helps marketing efforts.

Economy pricing

A no-frills brand or range of products have an economy pricing strategy which is based on a high volume of sales. Margins are low as are any overheads such as marketing costs. Many brands in a supermarket have an economy pricing strategy, and the supermarket itself will have this strategy. Targeting is at the mass market to gain a large market share, and there is little to differentiate any product besides the low price. The packaging is usually extremely basic.

Low price often equates to low quality in the eyes of customers, so there’s little chance of ever-increasing price as customers will be very price sensitive.

Skimming strategy

Initially charging a high price and then lowering it over time is a called a skimming strategy. This strategy is useful until the market has become saturated with competitors and lower the price accordingly. This strategy is usually only reserved for brands with a first-mover advantage or a strong competitive advantage such as a unique technological advancement. Wealthy segments of the market are usually targeted.

Examples of this are when mobile phones first become popular, texting and call charges were extremely high with just one or two providers. Similarly, with smartphones, the original series of the iPhones only had the one expensive model when there were not alternative android models for much cheaper with similar capacity.

Loss leaders

Whilst most of these pricing strategies are on a brand or product level; Loss Leaders is a store level strategy. Certain retailers such as supermarkets sell high profile and high volume brands such as Coca Cola at a low price, maybe at a slight loss depending on competition, intending to attract customers rather than being a profitable product. This strategy is based on the fact these customers are highly likely to purchase other products that are more profitable items.

You just want to get people into the store. Sales work the same way, a highly discounted TV because they might purchase the cabinet and home theatre that comes as a bundle. But often this is a day to day pricing strategy. After all, who goes to the supermarket just to grab some Coke, right? You will probably grab some potato chips or a bag of nuts, maybe some bread, toilet paper or milk, some bread, maybe some beer…

Differential pricing

Also known as discriminatory pricing or multiple pricing, differential pricing uses the law of demand as the key principal. Recognising that certain customers are willing to pay extra for a product based on the market segment they belong to; selling the same product or service to different customers at different prices.

Think about going to an auction for a property. If there are ten bidders, for example, they will also see value at a slightly different level. As the price goes up, the number of customers reduces.

Businesses can offer slightly different value propositions to different market segments with differential pricing. Pricing at a sports game or a concert is an example of differential pricing. Kid’s prices, family prices, corporate boxes, front row seats, VIP passes, season tickets… This helps the businesses maximise their potential profit by focusing on their customers’ unique valuations.

Brand Image in product segments such as clothing and cosmetics can also allow for different pricing in different markets, location, and time such as early bird tickers are another variable.

Competitive pricing

Also known as reference pricing, Competitor pricing is set by the market, priced just below the price of a competitor’s product. The term reference explains the use of the competitor’s price as a reference for the price, they are willing to pay.

In New Zealand, in the past because of our geographic isolation and low population, multi-national companies often leave us alone, leading to monopolistic and duopolistic markets. Telly-communications and Airlines in particular.

Air New Zealand has enjoyed a free market for extended periods, and occasionally a company like Jetstar or Virgin will come along to take a share of the market. Not often successfully. But when they do, forcing Air New Zealand to lower prices to match the competitors. Volumes of sales increase accordingly.

Going rate pricing is a by-product of highly competitive markets, where the companies have little to no control of the market price. E.g. Mobile phone rates are all similar and standardised across the market. The price of a regular-sized coffee is usually $5 in New Zealand, regardless of what café you visit.

Price promotion and discounts

Using price as a tool for sales promotion is common marketing and sales tactic. Usually, a product or service temporarily discounted in price. We have all seen it, 40% off all Tupperware for three days only! For many consumers, the value that they perceive in a brand’s product or service increases with a reduction in price. A short amount of time to purchase creates urgency around the transaction that the buyer might miss out.

Discount coupons are another form of price promotion which is also designed to promote brand awareness as the consumer a required to hold onto it physically, meaning brand recall should be higher as the coupon might be noticed often when rummaging through a purse or draw for example.

Price discounts often are a strategy to clear out-dated inventory. A study by Ailawadi, Lehmann and Neslin (2001) who looked at data from P&G when they changed their pricing strategy to cut deals and coupons and invest more into advertising, and they found coupons and discounts help with market penetration, but have little impact on customer retention and product usage. Overuse of discounting pricing can be harmful to a brand image over time and reduce the brand equity — being the premium a customer is willing to pay over a competitor.

Trade and volume discounts are common pricing strategies in B2B, especially in the trades with wholesale buyers. This also helps enhance loyalty as there are often many competitors in the market. Some products may have seasonal pricing, often summer clothing is on sale in the middle of winter and vice-versa.

Psychological pricing

Businesses can design their pricing to have a psychological impact on purchasers. Marketers using Psychological pricing to “trick” the customer’s brain into thinking the price is lower than it is. It is a common tactic in retail — we have all seen pricing at $99.99 instead of $100.00. The price rounds up to a hundred anyway, but the customer sees the 99. The lower number is more attractive to purchasers.

Everyday low price

Another store-level strategy, Everyday Low-Price strategy is popular with large format retailers. Margins low and therefore prices are low, selling in high volume. Think Walmart in the USA. People shop there because they know prices will be low, therefore the business does not need to spend money advertising their prices. You do not have to offer discounts to get people through the door. This saving on advertising costs keeps prices low and customer loyalty is often high, as people know what they are going to get and there are no gimmicks.

The two largest home and hardware store chains in New Zealand, Mitre 10 Mega and Bunnings Warehouse both use this strategy. It is more than just a pricing strategy; it is a business strategy.

Studies (See Montgomery, 1997) have shown that having micro-marketing pricing strategies instore — e.g. not promoting discounting options besides an aisle display that is low cost and low in labour, can improve profits by four to ten percent. This also allows organisations to maintain their consistent brand image but still alter prices to adapt to local markets.

Bundled pricing

When more than one product sold together at a lower than the price to buy the same items individually, this is a bundled pricing strategy. The products could be similar, e.g. shampoo and conditioner, or they could be dissimilar but under the same brand. This is an effective way for businesses to clear old stock. Buy one, get one free is an example of bundled pricing.

Other examples of bundled pricing are signing up for both power and broadband services from the same company and get a discount, or a bundle deal at the local pizza store to get 2 large pizzas, garlic bread and large drink for cheaper than purchasing individually. A Big Mac combo instead of a Big Mac. The strategy behind this approach is to stop customers dwelling on the price but instead on the benefits of the bundle.

Captive pricing

Captive pricing is where a primary product has secondary consumables that customers must purchase to function. Battery companies often manufacture torches for example or razor blades. The initial offering is cheap, but the consumables are not. This is a popular pricing strategy when there are other complementary goods you can also sell the consumer.

That is it for this week’s topic about pricing. I hope you learnt something new!

There are many strategies a business can use to base their pricing — hopefully, this makes it all a bit easier to understand.

No comments:

Post a Comment